Last week I had the pleasure of presenting two papers at the 2019 South Central SAS Users Group Educational Forum in Baton Rouge on the campus of the E. J. Ourso College of Business at Louisiana State University. My thanks to Joni Shreve and Jimmy DeFoor who chaired this conference and treated this traveler so well. (Especially want to call out the chicken and sausage gumbo). I want to reflect on two things. The students and SAS.

As a LSU Professor, Joni Shreve had an outsized role in not only serving the forum as its academic chair, but in also encouraging her MS Analytics students to attended over the two days, October 17-18, 2019. Many of those students attended one or both of my papers. I met most of them and had long side conversations with a few. To a person I was impressed with their interest in analytics and what this economist from up north had to say about the state of applied analytics. These students each have very solid futures. Of course I encouraged them to add an applied econometrics course to their studies (see here or here or even here).

When I started writing the papers for this conference I was focused on SAS. It is after all a SAS conference. I was happy to contribute what may be new SAS techniques to the participants, but the fuller message was not about SAS techniques, but about the process of problem solving, and turning insights into solutions. It is about telling the story, not of SAS, but of the problem and solution. Firm articulation of the problem and the development of a full on testing strategy are messages that rise above any particular software. I am grateful to participants, students and faculty alike who in conversation after assured me that they got the message.

The student are currently in a practicum where Blue Cross and Blue Shield of LA, Director of IT, Andres Calderon, as an Adjunct Professor at LSU, is directing them in a consultative role helping them solve a real business problem. This is ideal education for analytics students. I want to thank Andres for his kind words about my presentations and the value of them to the wider analytic community. I know our conversations will continue and I will be the better for them, better than that, so will the students.

I was made to feel a part of the LSU MS Analytics program if even for two days and I am grateful to Joni Shreve for letting me have that rewarding opportunity.

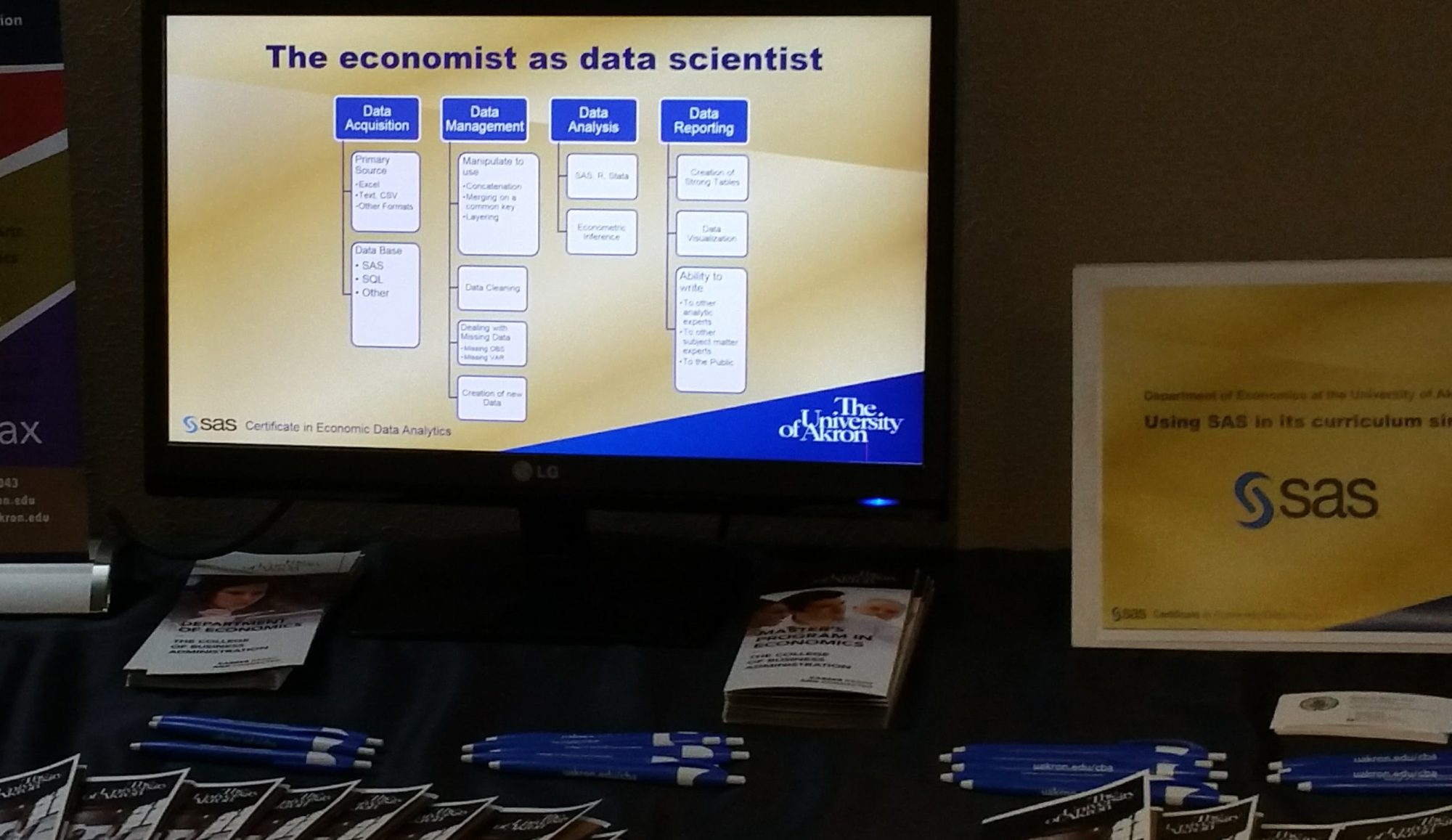

And about the picture, my wife has threatened to tell Zippy (UA mascot).

I am honored to have a version of this essay appearing in Bill Frank’s

I am honored to have a version of this essay appearing in Bill Frank’s