Originally posted to LinkedIn on October 26, 2022

A student today told me that air pollution was up. The fact is, that is not even close to the truth. Typically students (and many people) lean toward the pessimistic. It is little wonder with the constant blaring of bad news and fear-mongering from those whose agenda is attracting eyeballs or votes (or both). The truth, however, is a stubborn thing, but it is not always front and center.

Check out this graph from the US EPA from their report on Air Quality (https://www.epa.gov/air-trends/air-quality-national-summary, accessed October 26, 2022).

Source: EPA.gov image source https://www.epa.gov/system/files/images/2022-06/1970-2021%20Baby%20Graph_1.png

From 1970, aggregate emissions from 6 common pollutants are down 78%. CO2 alone is down 9%.

At the same time, we consumed 43% more energy, had a 62% growth in population, almost a 200% increase in miles traveled by gas-powered vehicles, and nearly a 300% growth in GDP. At the same time, our standard of living (measured by real GDP per capita) rose 244%. (source US BEA)

Most would conclude, I would observe, that with population and vehicle miles and GDP rising, of course, air quality has to suffer. But that is not the case. Why are people so pessimistic? The evidence everywhere is that the world improves.

I am not trying to simplify or dismiss real problems, but I am pointing out that the US is one of the world’s best examples of clean air. As countries get rich, they can spend more on cleaning their environment.

Ourworldindata.com says, “Death rates from air pollution are highest in low-to-middle income countries, with more than 100-fold differences in rates across the world.” Air quality is a normal good. As incomes rise and residents can move beyond mere survival demands, it becomes something they will demand. (https://ourworldindata.org/air-pollution).

The following graph shows worldwide death rates due to air pollution on the vertical axis. As countries become rich, they can afford to demand clean air. In the first graph below, countries defined as low-income are shown. The trend is downward for indoor air pollution, but the death rate due to all air pollution stands at 189 per 100,000 residents.

In the second graph, a similar trend is shown for countries the world bank classifies as rich, showing death rates from air pollution is falling. In 2019 the death rate from all air pollution in these high-income countries is 15 per 100,000 residents or less than 8 percent of the low-income countries. In other words, low-income countries, as of 2019, have shown a great reduction in air pollution deaths over time but have a death rate of almost 13 times the high-income countries.

When a country becomes richer, air quality gets better.

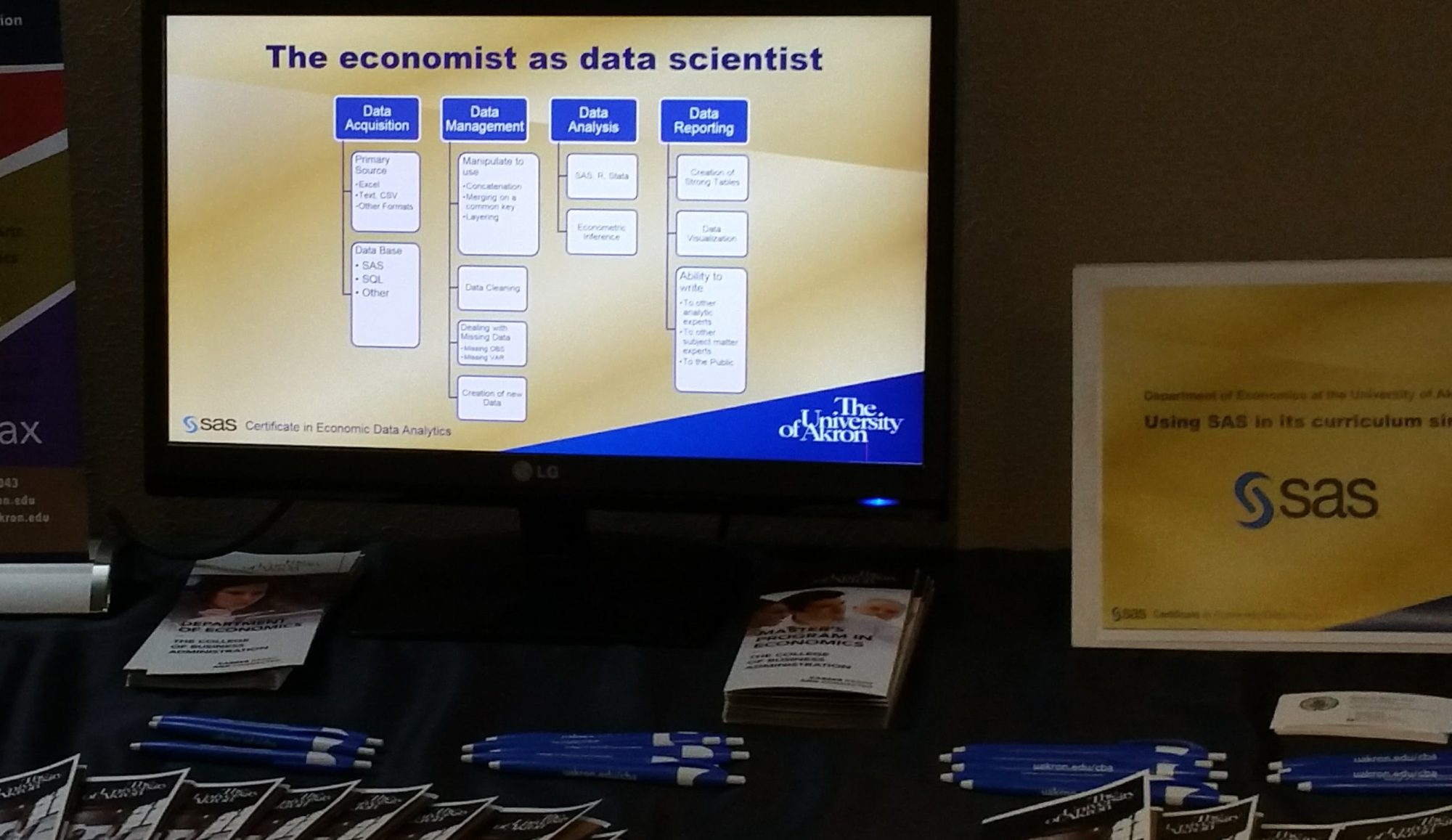

It has been 41 years since I began my academic career. I leave it at the end of this Spring semester and I will miss teaching econometrics and data science to our students. Those who know me understand my passion for SAS(r) in the econometrics curriculum and I am not dissuaded by the presence and importance of R and Python. Students who learn to program in SAS, learn far more than the analytic power of the worlds leading analytical solution. They learn in one environment how to acquire data, to manipulate and manage that data, to analyze it with powerful procedures and to visualize and report results from that data.

It has been 41 years since I began my academic career. I leave it at the end of this Spring semester and I will miss teaching econometrics and data science to our students. Those who know me understand my passion for SAS(r) in the econometrics curriculum and I am not dissuaded by the presence and importance of R and Python. Students who learn to program in SAS, learn far more than the analytic power of the worlds leading analytical solution. They learn in one environment how to acquire data, to manipulate and manage that data, to analyze it with powerful procedures and to visualize and report results from that data.