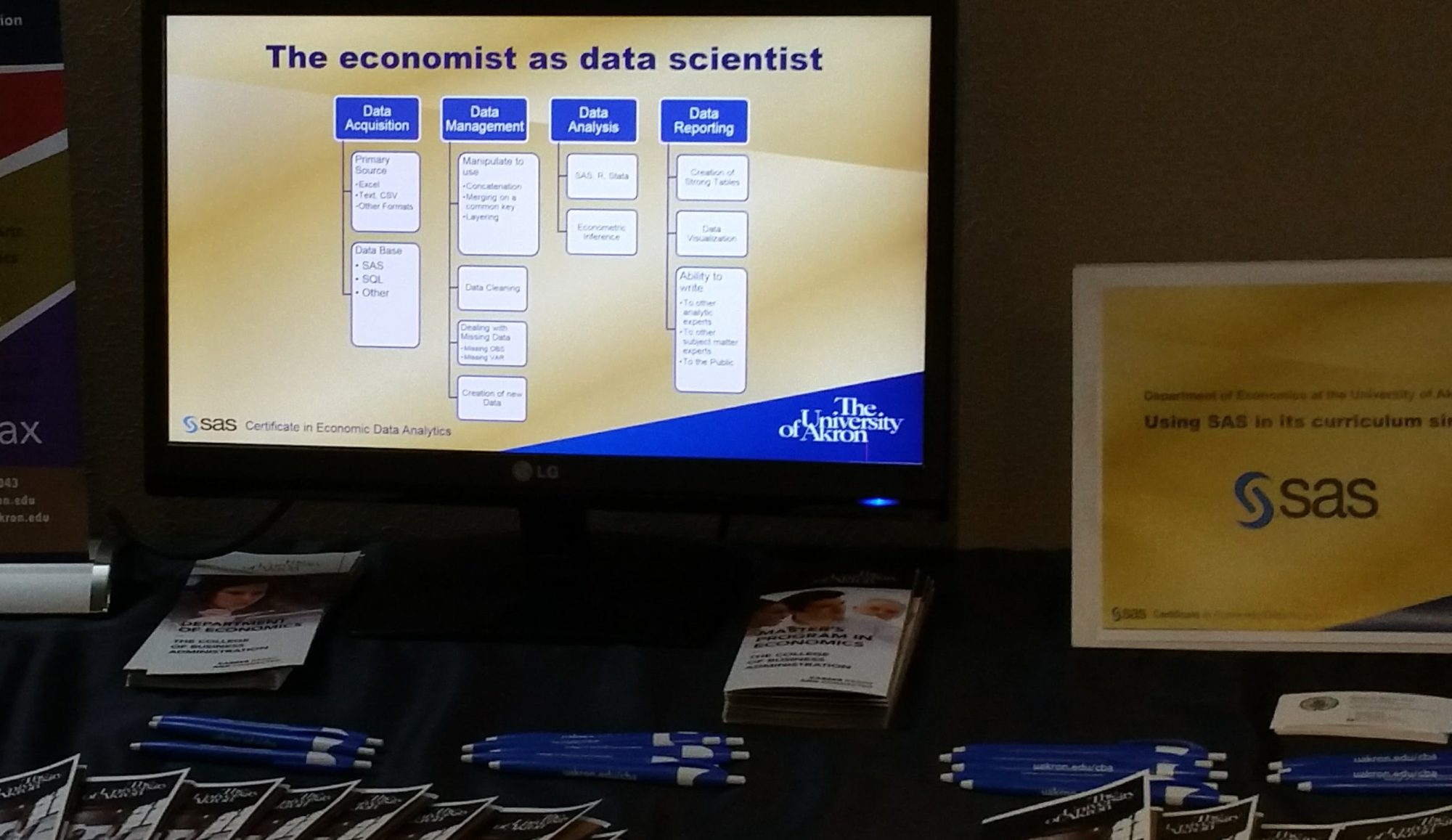

Economists make great data scientists. In part, this is because they all are trained in the four pillars of data science (1) data acquisition, (2) Data manipulation, cleaning and management, (3) analysis and (4) reporting and visualization. Good programs make sure that the economics students are trained in all four areas. Economists have subject matter expertise that is wrapped in a formalized way of thinking and problem solving ability. Quick answer, why are economists so valuable in business? – They know how to solve problems and tell stories from the evidence.

Economists make great data scientists. In part, this is because they all are trained in the four pillars of data science (1) data acquisition, (2) Data manipulation, cleaning and management, (3) analysis and (4) reporting and visualization. Good programs make sure that the economics students are trained in all four areas. Economists have subject matter expertise that is wrapped in a formalized way of thinking and problem solving ability. Quick answer, why are economists so valuable in business? – They know how to solve problems and tell stories from the evidence.

As to the analysis part of these pillars, economists are typically wrapped in causality and explanation of X in the y = f(X,e) model. Economists in forecasting become more interested in predicting y with less or much less on the factors X.

When I talk to many I hear data science being linked only with Machine Learning as if ML and data science are synonyms. This is far from the truth, with Data Science being very broad and ML a specific way and in some cases a dominate way of approaching a data problem. ML is making its way into economic curriculum. So what is the role of ML in economics now and into the future and more particularly the role between econometrics and ML?

No one in the economics profession knows more about the intersection of economics and machine learning than Susan Athey who just last month gave an address to the American Economic Association and the American Finance Association. I am posting this address so you may understand the current state.

The AEA/AFA address, Jan 2019

This video was captured at the joint luncheon for the American Economics Association and the American Finance Association that occurred at the January 2019 Annual Meetings in Atlanta.

Susan Athey who is The Economics of Technology Professor of the Graduate School of Business at Stanford University delivers the address and is introduced by Ben Bernanke, former FED chair, now at the Brookings Institution.

Economists as engineers: A new Chapter

(0:59:25) “The AI and econometric theory need work, but they are not the main constraint…. Instead the success is going to depend on understanding the context, understanding the setting….

“(The economist can be) motivated by social science research about where should I be spending my time, where should I be intervening? (Economists need) to use empirical work to help figure out what the best opportunities are.

Economists can help with defining measures of success. We need to recognize that AI has billions of ways to optimize so we better be telling the algo the right thing. Those algos need to be constrained and informed by

(1:01:22) “Broadly, when economists return to their institutions that are building AI and data science initiatives that … the social scientists (she thinks) are going to be more important than the computer scientist in terms of what is the conceptual thing, what is the thing that makes something succeed or fail, that makes it screw up and have adverse consequences versus being really successful and impactful. We (economists) are going to need to join interdisciplinary teams and the evaluation will be embedded and not separable from the system. So that means we are going to have the opportunity to intervene in the world like we never have before. But it also comes great responsibility because we will be the people in the room who really can understand the good and the bad and make sure it happens in a safe way.””