As the new decade begins, I am preparing for my flight to San Diego where my colleague, Sucharita, and I will be interviewing for the Department of Economics as we seek to hire two tenure-track assistant professors for the department to replace the three faculty who are leaving in May. I always enjoy the ASSA (Allied Social Science Association) meetings, but this time I will miss all of the sessions and activities as we have a full interview schedule. As I have reported Data Scientist Jobs Are Increasing For Economists: Evidence from the AEA. We are looking for those who will teach data science to our students.

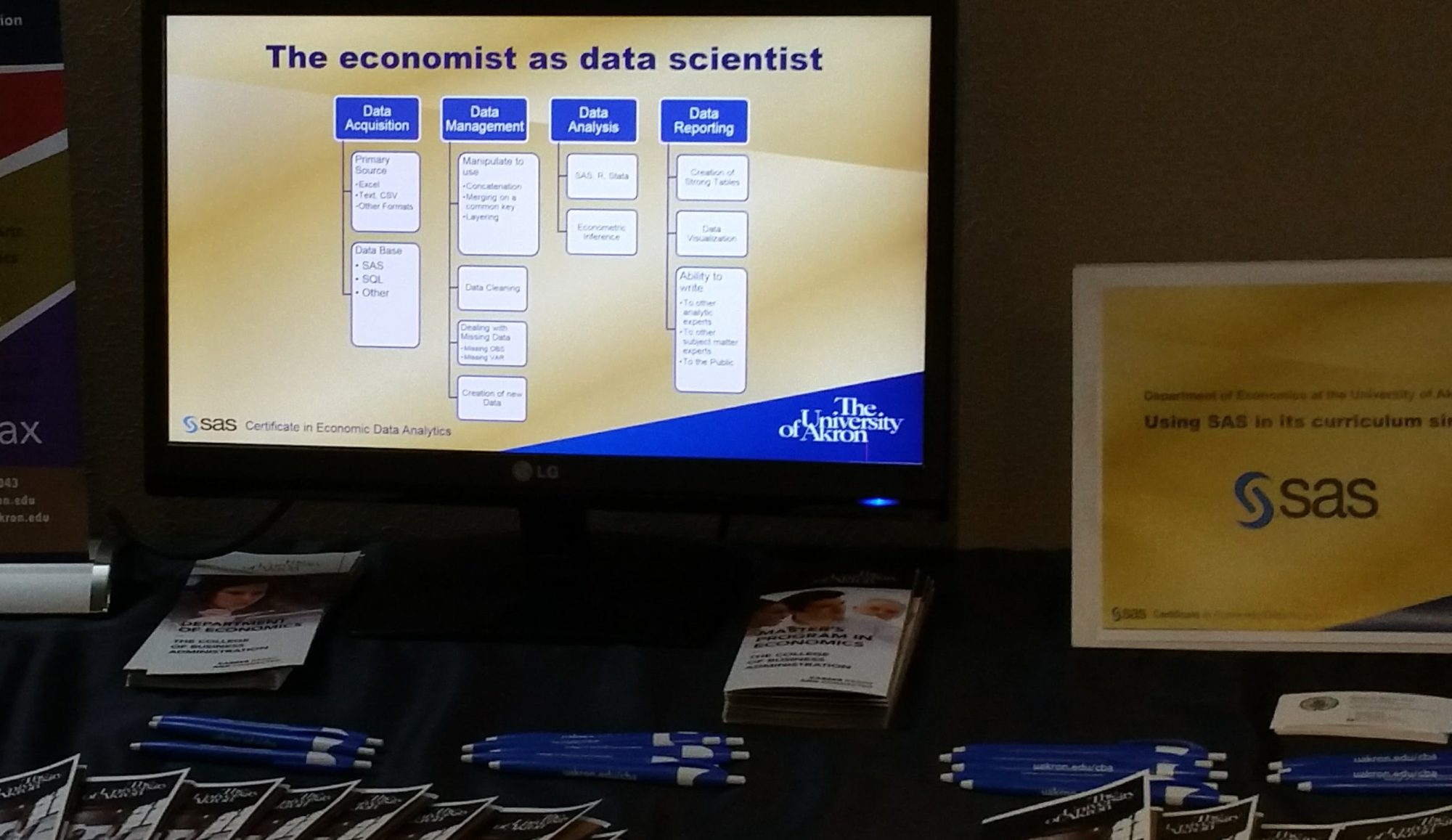

It has been 41 years since I began my academic career. I leave it at the end of this Spring semester and I will miss teaching econometrics and data science to our students. Those who know me understand my passion for SAS(r) in the econometrics curriculum and I am not dissuaded by the presence and importance of R and Python. Students who learn to program in SAS, learn far more than the analytic power of the worlds leading analytical solution. They learn in one environment how to acquire data, to manipulate and manage that data, to analyze it with powerful procedures and to visualize and report results from that data.

It has been 41 years since I began my academic career. I leave it at the end of this Spring semester and I will miss teaching econometrics and data science to our students. Those who know me understand my passion for SAS(r) in the econometrics curriculum and I am not dissuaded by the presence and importance of R and Python. Students who learn to program in SAS, learn far more than the analytic power of the worlds leading analytical solution. They learn in one environment how to acquire data, to manipulate and manage that data, to analyze it with powerful procedures and to visualize and report results from that data.

SAS is a great skill for students and their proficiency with SAS prepares them both for careers in SAS and for careers using other languages and systems. I argue from the experience of my students that SAS provides a platform from which those students may easily learn any other language or system that an employer will have. I cannot say the same for R and Python, partly out of ignorance and partly because I have not heard or read that R and Python provide the same firm foundation for future learning of other languages and systems.

Every new Ph.D. economist we interview will be proficient in STATA, few will be proficient in SAS, and many will not list SAS in their skill set. The willingness of the candidate to learn and teach SAS is critical to our Economics and Business Data Analytics programs. The University of Akron partners with SAS Global Academic Programs and offers a joint Certificate in Economic Data Analytics to each qualified graduate. Our students are ready to turn data into action using SAS and the unique qualities of critical thinking, problem solving and story telling that is part of all economic curriculums. Economists do put the science into data science. Data Science is far more than predictive analytics. You can make predictive analytics work beautifully in many cases, but there is no substitution for knowing why something works. Economists are masters of explanation and causality, and have the statistical prowess to back it up.

In an earlier blog posting I reviewed the data science textbook I used last semester (A Data Science Book Adoption: Getting Started with Data Science) and in one of the figures I showed that in Ohio while there were over 600 jobs lisiting ‘SAS; there were just fewer than 30 listing ‘STATA.’ Today as I write this there are 521 SAS listings and only 15 STATA listings in Ohio, and nationwide the numbers are 17K SAS jobs to 1.5K STATA jobs. (Indeed.com). I think we are on the right track.

Teaching economics and econometrics with SAS gives students a firm foundation for productive and profitable analytic careers in all data science fields. And our students have done very well in that space.

Wish us luck as we look for two new assistant professors of economics who will contribute to our students’ success. And for those who have read this far, I have been honored as the SAS Distinguished Educator for 2020 and will receive that award at the SAS Global Forum in Washington DC (March 29-April 1). I will also speak on educating economics students for data science careers. You too can attend, register here. Message me at LinkedIn if you are coming, I would love to see you. – Steven C. Myers (Akron)